The Perfect Mortgage Starts Here

Choice Financial is a local mortgage brokerage that offers our clients the best mortgage and terms we feel will most benefit the clients unique situation.

Choice Financial is a local mortgage brokerage that offers our clients the best mortgage and terms we feel will most benefit the clients unique situation.

About Choice Financial

━━━━━━━━

At our company, we prioritize our clients' goals by focusing on our first objective: helping them achieve the results they desire. We understand that purchasing a dream home often requires securing the necessary financing, and we are here to assist in that process. Our team of experts is dedicated to providing personalized support and guidance to ensure our clients' financing needs are met. Whether it's finding the right mortgage options or exploring alternative funding sources, we leverage our industry knowledge and network to help our clients turn their dreams into reality. With our comprehensive services and unwavering commitment, we strive to be the partner our clients can rely on to navigate the financing journey and secure the funds needed to purchase their dream home.

Here is why you are in great hands with Choice Financial

2500+

Clients Helped

30+

Combined Years

of Experience

20+

Mortgage Brokers/Agents

Our Services

Comprehensive mortgage solutions tailored to your unique needs and financial situation

First-Time Home Buyer

Expert guidance for first-time buyers with competitive rates and personalized advice to make your homeownership dream a reality.

- Down payment options

- Government programs

- Step-by-step guidance

Refinancing

Lower your payments and access your home's equity with our competitive refinancing options and expert market knowledge.

- Lower interest rates

- Cash-out options

- Payment reduction

Home Equity Loan

Unlock your home's equity for renovations, investments, or major expenses with competitive rates and flexible terms.

- Competitive rates

- Flexible terms

- Quick access to funds

Reverse Mortgage

For seniors 55+, access your home's equity without monthly payments. Stay in your home and improve your retirement lifestyle.

- No monthly payments

- Stay in your home

- Tax-free income

Second Mortgage

Alternative financing solutions with flexible approval criteria when traditional lending doesn't fit your situation.

- Flexible criteria

- Quick approvals

- Alternative solutions

Mortgage Renewal

Don't automatically renew! We'll find you better rates and terms to save you thousands over your mortgage term.

- Better rates

- Improved terms

- Thousands in savings

Self-Employed

Specialized mortgage solutions for self-employed individuals with flexible income verification and competitive rates.

- Flexible income verification

- Competitive rates

- Fast approvals

Debt Consolidation

Simplify your finances by consolidating high-interest debts into one low monthly payment with better terms.

- Lower monthly payments

- Reduce interest rates

- Simplify finances

Investment Properties

Build your real estate portfolio with financing solutions designed for investment properties and rental income qualification.

- Portfolio financing

- Rental income qualification

- Investment strategies

What Our Clients Say

Don't just take our word for it. Here's what real clients have to say about their Choice Financial experience.

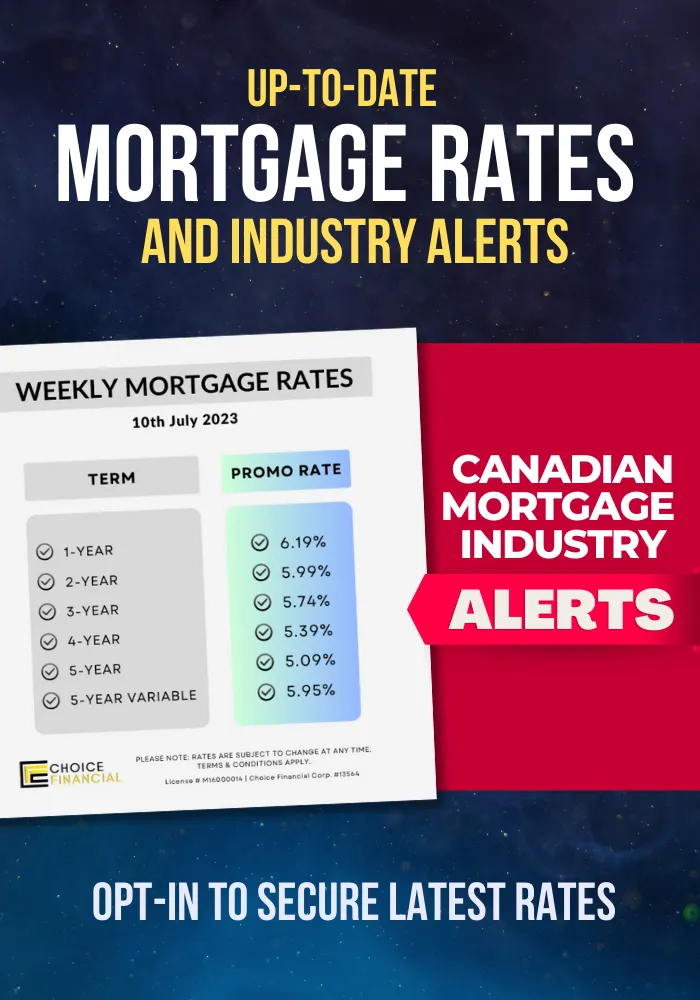

Sign up for our weekly mortgage rates and industry news.

Power of Home Equity: Transform Your Finances with Second Mortgages!

Are you ready to supercharge your homeownership experience? Owning a property isn't just about having a place to call home; it's about seizing the opportunity to shape your dream living space. Beyond that, it's about leveraging the incredible potential of your home's equity to redefine your financial landscape. In this dynamic guide, we'll explore how second mortgages can empower you to achieve your financial goals, even if you have faced credit challenges.

Second Mortgages: Your Path to Financial Freedom

Imagine having the ability to tap into your home's equity like a financial wizard, using the funds for your child's education, home improvements, debt consolidation, or even to halt foreclosure in its tracks. Canadian homeowners with less-than-perfect credit scores are increasingly turning to second mortgages to harness the true potential of their properties. Let's dive into the exhilarating world of second mortgages and discover how they work their magic!

The Power of Second Mortgages

A second mortgage is not just another loan; it's your secret weapon for financial flexibility. Think of it as a separate loan, secured by the value of your home, running parallel to your primary mortgage. As you build equity in your property, the amount you can borrow through a second mortgage increases. Most lenders allow homeowners to access up to 80% of their hard-earned equity.

Whether you opt for a Home Equity Line of Credit (HELOC) or a lump-sum payment, second mortgages offer a game-changing advantage. They enable you to make interest-only payments, reducing your monthly financial burden and freeing up your budget for other essential expenses. Second mortgages can be your ally in home renovations or debt consolidation, offering unparalleled financial flexibility.

How a Second Mortgage Can Transform Your Credit

For many Canadians, juggling multiple debts can be a daunting challenge. Whether it's overwhelming credit card balances or auto loans that seem insurmountable, the stress of managing these financial obligations can take its toll. However, there's a brilliant solution on the horizon – the second mortgage.

By consolidating your debts with a second mortgage, you eliminate the hassle of juggling multiple payments. Instead, you'll enjoy the simplicity of a single, manageable monthly payment. With the funds from your second mortgage, you can settle your outstanding bills and focus on that single, affordable payment. This strategy not only reduces your debt load but also alleviates the stress of multiple monthly payments.

As you chip away at your loans or credit card debts, you're not only regaining control of your finances but also actively working to improve your credit score. Debt consolidation through a second mortgage can be the catalyst for your journey to financial freedom.

Unlocking Second Mortgages with Bad Credit

You might wonder if a second mortgage is within reach, especially if you've faced credit challenges. Traditional lenders often rely heavily on credit scores, making approval seem like an uphill battle. However, there's hope, and it comes in the form of private lenders.

Private lenders are more flexible when it comes to credit requirements. They prioritize factors such as the marketability of your home and the equity you've built up, rather than fixating on your credit history. This opens the door to securing a second mortgage, even if you have bad credit.

The key is finding the right private lender, and that's where Choice Financial steps in. We specialize in connecting homeowners with private lenders who understand that your home's potential is far greater than a credit score.

Let Us Help You Unleash Your Home's Potential

Ready to embark on a journey to financial empowerment through a second mortgage? At Choice Financial, we're dedicated to helping Canadian homeowners secure financing for their homes and unlock the potential of their properties. With years of experience and a track record of success, our team is your trusted partner in achieving your financial goals.

Getting started is as simple as reaching out to us and providing the necessary documentation. We're just a phone call away, ready to answer your questions and guide you every step of the way. Don't wait any longer to harness the full potential of your home – contact Choice Financial today, and let's make your financial dreams a reality!

Want to work with us?

Let's discuss your mortgage goals and create a personalized strategy that works for you.

Our team brings years of experience in residential and commercial lending, with a commitment to finding solutions that fit your lifestyle and financial objectives.

Contact us today for a no-obligation consultation.

Choice Financial Corp. #13564

Independently owned and operated

Licensed in

Ontario FSRA # 13564

Alberta: RECA

CF Choice Financial Corp:

B.C: BCFSA #MB605782

COMPANY

CUSTOMER CARE

Copyright 2026. Choice Financial Corp.. All Rights Reserved.

Privacy Policy - Terms ofUse