The Perfect Mortgage Starts Here

Choice Financial is a local mortgage brokerage that offers our clients the best mortgage and terms we feel will most benefit the clients unique situation.

Choice Financial is a local mortgage brokerage that offers our clients the best mortgage and terms we feel will most benefit the clients unique situation.

About Choice Financial

━━━━━━━━

At our company, we prioritize our clients' goals by focusing on our first objective: helping them achieve the results they desire. We understand that purchasing a dream home often requires securing the necessary financing, and we are here to assist in that process. Our team of experts is dedicated to providing personalized support and guidance to ensure our clients' financing needs are met. Whether it's finding the right mortgage options or exploring alternative funding sources, we leverage our industry knowledge and network to help our clients turn their dreams into reality. With our comprehensive services and unwavering commitment, we strive to be the partner our clients can rely on to navigate the financing journey and secure the funds needed to purchase their dream home.

Here is why you are in great hands with Choice Financial

2500+

Clients Helped

30+

Combined Years

of Experience

20+

Mortgage Brokers/Agents

Our Services

Comprehensive mortgage solutions tailored to your unique needs and financial situation

First-Time Home Buyer

Expert guidance for first-time buyers with competitive rates and personalized advice to make your homeownership dream a reality.

- Down payment options

- Government programs

- Step-by-step guidance

Refinancing

Lower your payments and access your home's equity with our competitive refinancing options and expert market knowledge.

- Lower interest rates

- Cash-out options

- Payment reduction

Home Equity Loan

Unlock your home's equity for renovations, investments, or major expenses with competitive rates and flexible terms.

- Competitive rates

- Flexible terms

- Quick access to funds

Reverse Mortgage

For seniors 55+, access your home's equity without monthly payments. Stay in your home and improve your retirement lifestyle.

- No monthly payments

- Stay in your home

- Tax-free income

Second Mortgage

Alternative financing solutions with flexible approval criteria when traditional lending doesn't fit your situation.

- Flexible criteria

- Quick approvals

- Alternative solutions

Mortgage Renewal

Don't automatically renew! We'll find you better rates and terms to save you thousands over your mortgage term.

- Better rates

- Improved terms

- Thousands in savings

Self-Employed

Specialized mortgage solutions for self-employed individuals with flexible income verification and competitive rates.

- Flexible income verification

- Competitive rates

- Fast approvals

Debt Consolidation

Simplify your finances by consolidating high-interest debts into one low monthly payment with better terms.

- Lower monthly payments

- Reduce interest rates

- Simplify finances

Investment Properties

Build your real estate portfolio with financing solutions designed for investment properties and rental income qualification.

- Portfolio financing

- Rental income qualification

- Investment strategies

What Our Clients Say

Don't just take our word for it. Here's what real clients have to say about their Choice Financial experience.

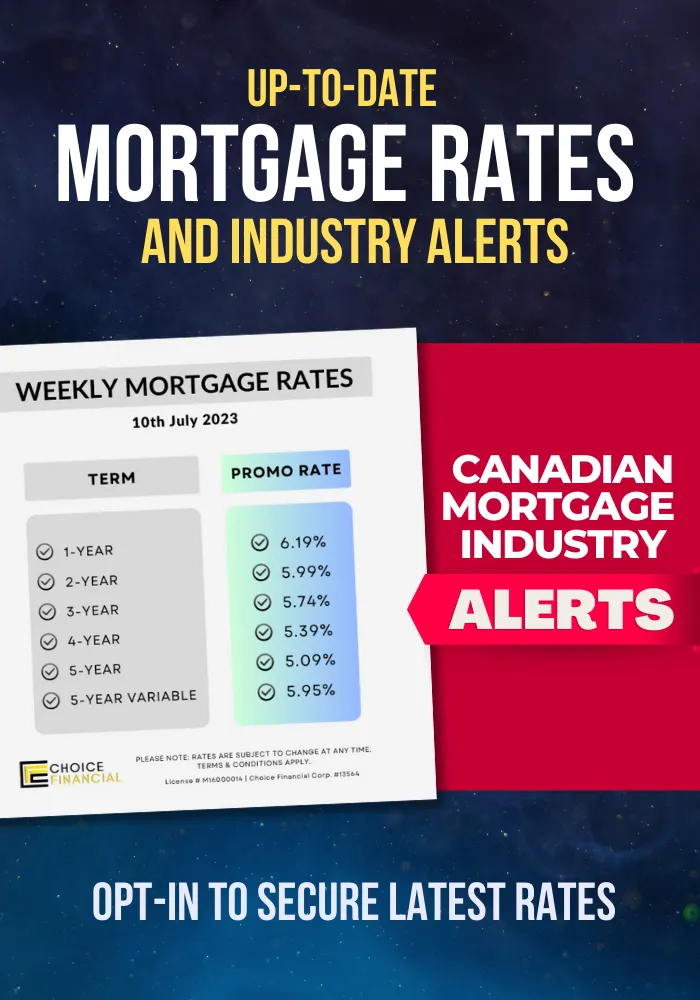

Sign up for our weekly mortgage rates and industry news.

Introducing the Canadian First Home Savings Account: Your Pathway to Homeownership

The journey to homeownership just got a whole lot easier with the introduction of the Canadian First Home Savings Account. This innovative financial tool is designed to empower first-time homebuyers like never before, offering a range of benefits that can help you turn your homeownership dreams into reality. In this blog post, we'll delve into the exciting benefits of the Canadian First Home Savings Account and why it's a game-changer for anyone looking to purchase their first home in the Great White North.

Benefit 1: Tax-Free Savings

One of the most appealing features of the Canadian First Home Savings Account is its tax-free savings status. Similar to a Registered Retirement Savings Plan (RRSP) or Tax-Free Savings Account (TFSA), the money you contribute to this account grows tax-free. Whether you're saving for a down payment or other homeownership-related expenses, you won't have to worry about capital gains or income tax on the interest earned within this account. This means you get to keep more of your hard-earned money for your home.

Benefit 2: Higher Contribution Limits

To accelerate your path to homeownership, the Canadian First Home Savings Account offers higher annual contribution limits compared to a TFSA. You can contribute up to $15,000 per year, allowing you to save for your dream home more quickly. Plus, your contributions can be made in addition to your regular TFSA and RRSP contributions, so you can take advantage of multiple savings avenues simultaneously.

Benefit 3: First-Time Homebuyer Grant

Here's where the Canadian First Home Savings Account truly shines. The federal government has introduced a generous First-Time Homebuyer Grant program that complements this account. When you're ready to purchase your first home, you can withdraw funds from your account and receive a 25% government grant on the amount withdrawn, up to a maximum of $10,000. This means you could receive up to $2,500 as a grant to put towards your home purchase! This grant can be a significant boost towards your down payment or closing costs, making homeownership more attainable.

Benefit 4: Flexible Investment Options

The Canadian First Home Savings Account is incredibly flexible when it comes to investment options. You can choose from a variety of investment vehicles, such as high-interest savings accounts, GICs (Guaranteed Investment Certificates), or even invest in the stock market through mutual funds or ETFs (Exchange-Traded Funds). This flexibility allows you to tailor your investment strategy to align with your risk tolerance and financial goals.

Benefit 5: No Minimum Income Requirements

Unlike some other government assistance programs, the Canadian First Home Savings Account has no minimum income requirements. This means that Canadians from all income levels can benefit from the account, making homeownership accessible to a broader range of people.

Benefit 6: Portable Account

Another significant advantage of this account is its portability. If you move, change jobs, or experience a life change, your Canadian First Home Savings Account can move with you. You won't lose the benefits or savings you've accumulated, ensuring you can stay on track towards homeownership no matter where life takes you.

Benefit 7: Community Support

The Canadian First Home Savings Account program also includes resources and support to help first-time homebuyers navigate the complex process of buying a home. From financial planning tools to educational webinars and workshops, you'll have access to a wealth of information and assistance every step of the way.

In conclusion, the Canadian First Home Savings Account is a game-changer for first-time homebuyers in Canada. With tax-free savings, a generous government grant, higher contribution limits, and flexible investment options, this account is the perfect tool to help you achieve your homeownership dreams faster and more efficiently. Don't miss out on this incredible opportunity to secure your future in your very own Canadian home. Start saving today and pave the way to a brighter and more secure future!

Want to work with us?

Let's discuss your mortgage goals and create a personalized strategy that works for you.

Our team brings years of experience in residential and commercial lending, with a commitment to finding solutions that fit your lifestyle and financial objectives.

Contact us today for a no-obligation consultation.

Choice Financial Corp. #13564

Independently owned and operated

Licensed in

Ontario FSRA # 13564

Alberta: RECA

CF Choice Financial Corp:

B.C: BCFSA #MB605782

COMPANY

CUSTOMER CARE

Copyright 2026. Choice Financial Corp.. All Rights Reserved.

Privacy Policy - Terms ofUse